Following up on yesterday’s predictions, here’s the second five – in no particular order… cf

6. Claims counts will bump up

In hurricane-ravaged Puerto Rico, Florida and Texas. Alas a lot of injuries and illnesses will go unreported as unscrupulous companies hire day laborers and don’t insure them, or, in Texas, where work comp isn’t required.

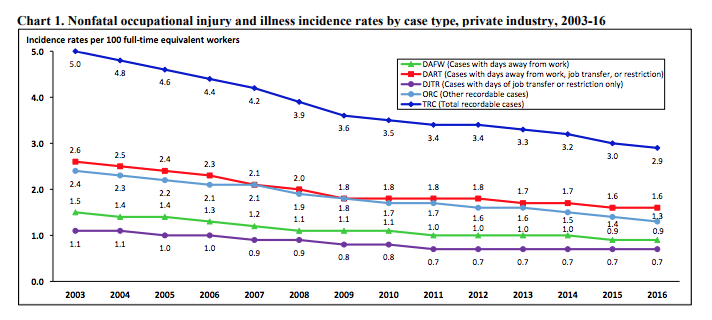

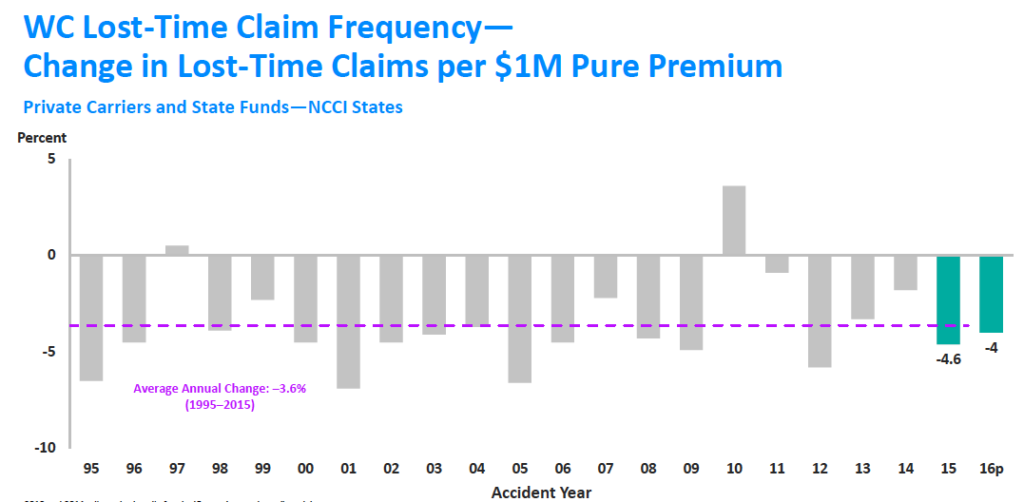

7. But frequency will continue to decline, and total claims will too.

because a) frequency almost always declines, and b) we are at or very close to full employment, so a growth in employment won’t counterbalance structural decreases in frequency.

8. Work comp medical costs will increase slightly

On a per-claim basis, expect costs were slightly higher in 2017 than the previous year. Per-claim figures are the best measure, although total medical spend is helpful as well. Kathy Antonello will tell us at NCCI’s Annual Issues Symposium in May…

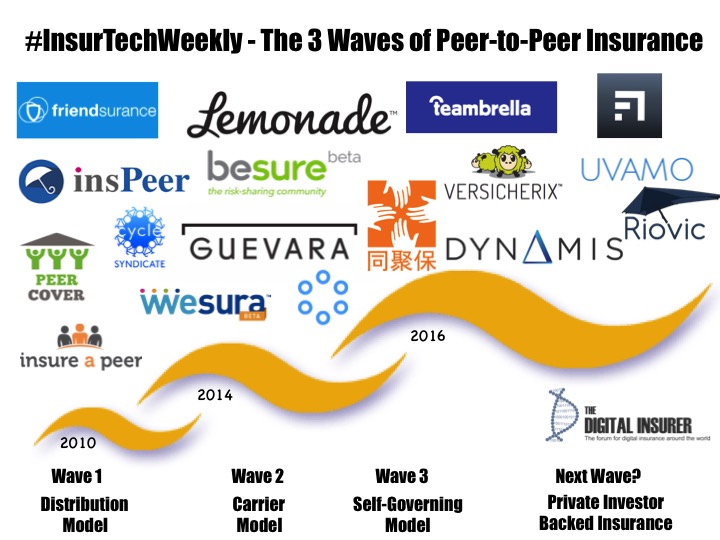

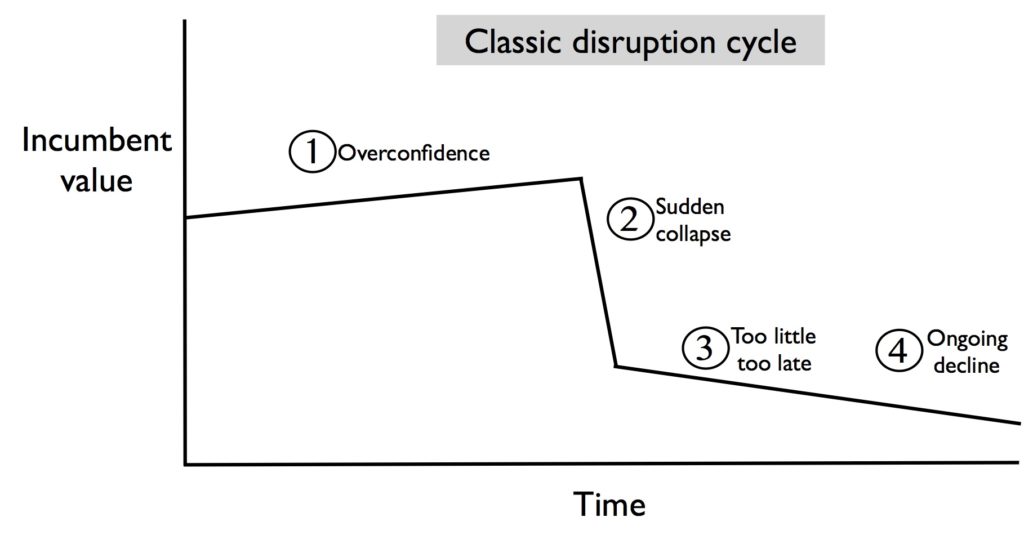

9. Innovative new approaches to financing work comp risk will emerge

Variations of peer-to-peer such as Lemonade, some enabled by blockchain technology, will gain a toehold in a few states. Don’t expect there to be a major move just yet as the regulatory, capital requirements, and distribution channels are going to adapt slowly. That said, there’s just too much opportunity to reduce costs inherent in the inefficient administrative processes in today’s workers’ comp system.

10. Payroll fraud incidents and other even more creative efforts to screw workers will increase

I’ll be looking at this in detail, but one quick take is the number of “contingent workers” in many industries has grown dramatically. The biggest increases? farming, fishing forestry; logistics; personal care; protective service, education and training. The implications for comp are deep and broad; lower premiums, claiming incentives, fraud.

I know, there are implications aplenty for claims, occupational injury rates and the like.

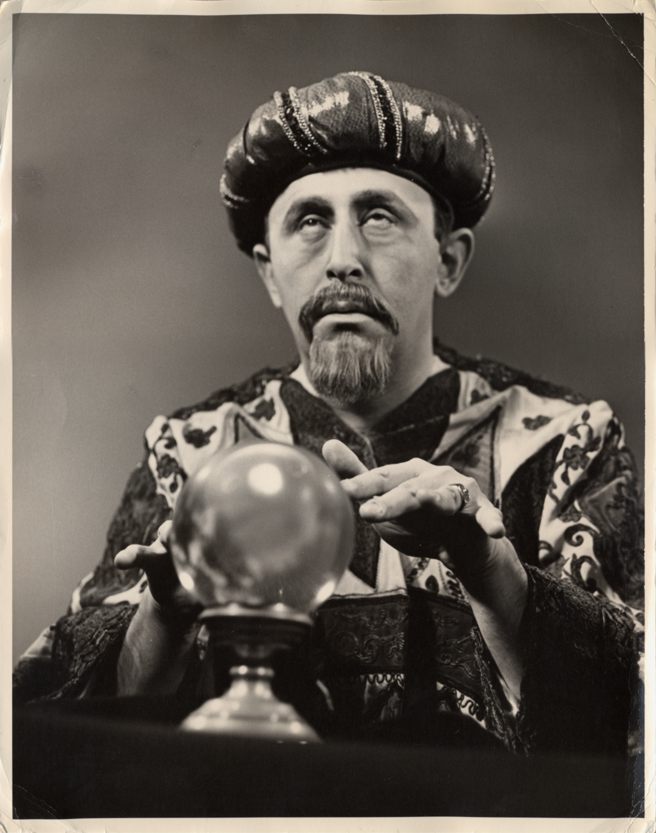

Clearly not a self-portrait; I could never grow that facial hair…

Clearly not a self-portrait; I could never grow that facial hair…