Costs for hospital-based care – driven by large price increases – are increasing faster than any other medical service.

in the period 2007–14 hospital prices grew substantially faster than physician prices. For inpatient care, hospital prices grew 42 percent, while physician prices grew 18 percent. Similarly, for hospital-based outpatient care, hospital prices grew 25 percent, while physician prices grew 6 percent. [emphasis added]

While there are any number of public policy changes that could address the problem, group health and workers’ comp payers can’t wait for legislative or regulatory action – they need solutions now.

First, we have to know why and where prices are increasing to come up with viable solutions. The study referenced above used case-mix adjusted data from 3 large health insurers – Aetna, Humana, and UnitedHealthcare, using the actual prices negotiated by these giant healthplans. (these plans cover over a quarter of all Americans with employer-sponsored health insurance.) I won’t get into the nits of the research – for wonks, it’s all in the link (subscription required).

Hospitals and health systems are able to raise prices because – in many areas – they have close to monopolistic pricing power. That is, even giant health insurers aren’t able to negotiate low prices because health systems have dominant market share.

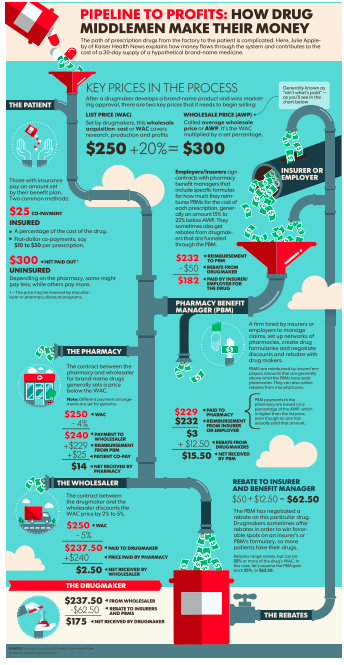

If giant healthplans don’t have much bargaining power, workers’ comp networks and payers have next to none. Remember, the total amount of medical spend from all payers in the US is about 1.25 percent of total US medical spend. From another HealthAffairs article:

other insurers [defined as auto and work comp] typically lack sufficient patient volume to establish network contracts with hospitals because they usually insure only a small proportion of a hospital’s patients.

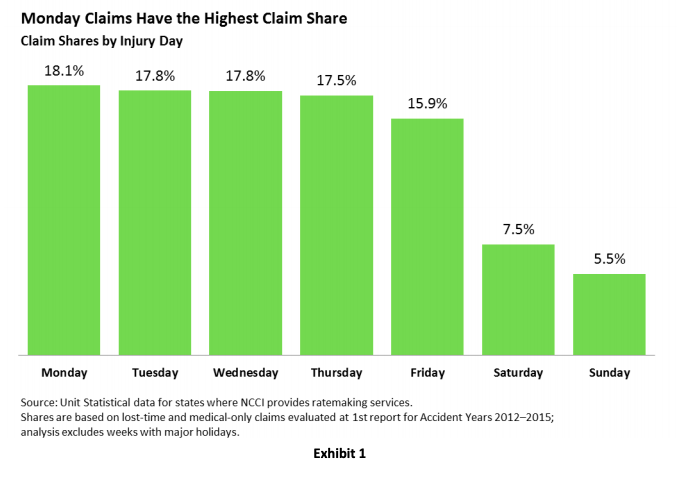

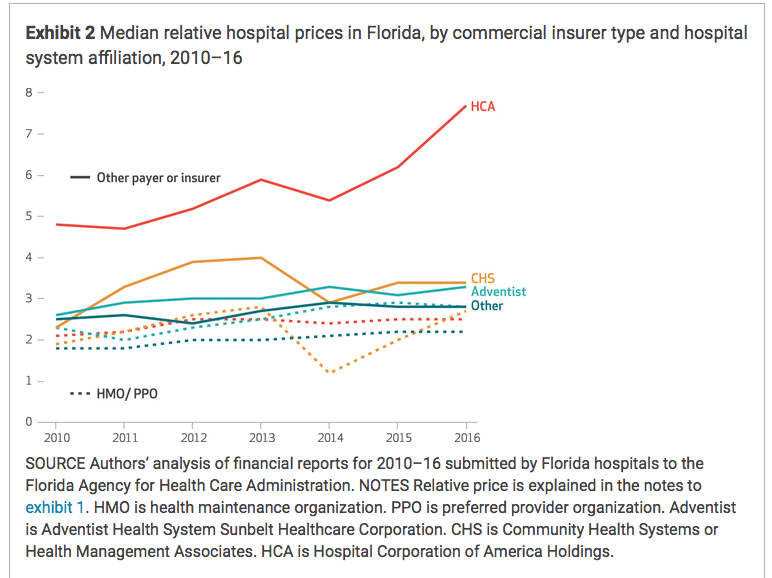

The article is well worth purchasing, however it does have a possibly significant limitation; it uses Florida data – the Florida work comp fee schedule is easily and usually gamed by hospitals, so the research may not be applicable to other states. That said, here are the key takeaways:

- For-profit hospitals charge significantly higher prices than not-for-profits

- For-profit hospitals generate almost a quarter of their margin from “other payers” (that’s you, auto and work comp)

- Hospitals affiliated with HCA had the highest price increases during the study period and the highest prices for “other payers”

Graph credit HealthAffairs

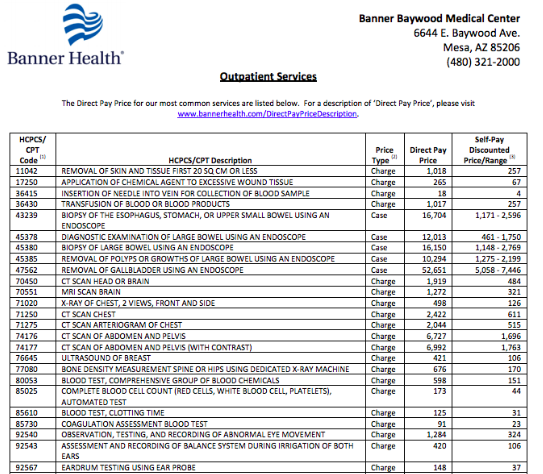

So, what to do? There are two issues here – what facilities your claimants use, and how those facilities bill you.

- Review your PPO contracts to identify for-profit health systems

- Do a quick analysis to compare what you pay (NOT THE DISCOUNT, WHICH IS IRRELEVANT) different facilities for similar services

- Direct your patients to the lower-net-cost facilities.

- Or, skip the analysis and just direct patient to not-for-profit facilities.

Tomorrow, we’ll focus on cutting costs on individual bills.

What does this mean for you?

Work comp and auto is a very soft target for profit-maximizing providers – but you aren’t powerless.