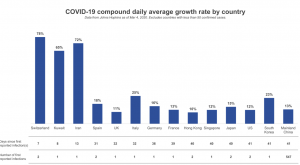

WCRI’s annual meeting was well attended…timing is everything. Many other events have been cancelled or postponed, especially those on the west coast – not to mention Italy, Iran, and Asia.

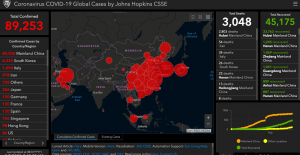

Here’s what we know about Covid-19 (the disease caused by the coronavirus) so far.

- there will be NO vaccine for at least a year – and likely more.

- it effects different people very differently, with some infected with the virus showing no disease symptoms, others severely ill or even dying.

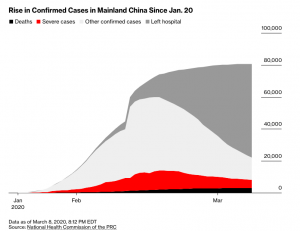

- 110,000 cases worldwide confirmed

- 3800 deaths – mostly among people who are elderly, have compromised immune systems, or underlying health problems especially pulmonary-related

- the virus has been identified in 97 countries

- China has seen a significant drop in new cases

Those are the facts – here’s stuff that may be true, or is uncertain as of now.

- the death rate for confirmed cases appears to be between 2% (apparent rate in China) and 1% (researchers speculating). Note the italics; it is possible, if not likely, that there are many more unconfirmed cases or untested patients that are not dying, thus the death rate may be significantly lower. Also, note that the death rate derived from the number above is significantly higher; that may well be due to lack of testing that would have identified many patients early on who did not die.

- if these figures hold up, Covid-19 will be much deadlier than most other flu varieties which have a mortality rate of 0.1% – again much higher in vulnerable populations

- the growth in the number of confirmed cases varies greatly by country – in general, it is doubling every week or so.

What does this mean for you?

Don’t over-react. This isn’t Ebola or the Black Death – and may be significantly less deadly than the Spanish Flu of a century ago.

Travel isn’t a no-no. I’m headed to Florida today – so it’s not just happy talk from your loyal reporter. And the WHO agrees.

What IS stupid/irresponsible/selfish is engaging with other people or being in public spaces if you feel ill. A jackass did just that last week – he happens to work at Dartmouth Hitchcock, where our eldest daughter is also employed. Needless to say, he’s on the poop list.

Mostly, chill.