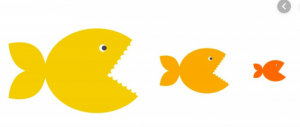

Last week we pondered Paradigm’s future, before that we mused about Mitchell’s. Today we opine about Optum.

First, a little history. Back in the Pleistocene, I worked for what was then UHC. United Healthcare was considered the best managed care company in the country, had a massive $6 billion in revenues and was expanding everywhere. After spending about 9 months carrying a UHC card, I departed, a lot less starry-eyed.

UHC has been in and out of workers’ comp about as often as Brad Pitt enters and exits relationships…

For those interested in digging deep into UHC’s workers’ comp history, at various times, the company owned:

- a technology business focused on bill review (Power-Trak…later sold to Mitchell);

- MetraComp, A WC PPO and managed care firm (and a former employer) and

- Focus (this last of some interest to one reader in particular :)…also,

- here is a brief note on UHC’s ill-fated entry into workers’ comp insurance back in the nineties. (spoiler alert – that damn tail will always get you.)

- much more recently UHC’s Optum got into the work comp PBM business in a very big way, buying Catamaran.

Writing about UHC’s foray into WC 6 years ago I opined that while really small potatoes compared to group health/MM, WC is attractive for a number of reasons:

In contrast (to UHC’s group health, Medicare and Medicaid (MM) business, work comp regulatory risk, while significant, is limited to what individual states do. If one state makes a change, it has zero impact on the others, thereby minimizing regulatory risk.

There are a number of other nice things about UHCs work comp business:

-

-

-

-

- it’s a fee business, without insurance risk

- margins are pretty healthy; a lot higher than group/governmental programs

- it has scale; when all the dollars are combined it’s a substantial player

- minimal investment is required as the businesses are mature and operating pretty successfully with experienced management and solid brands

-

-

-

Of late, UHC has stepped up its hiring in an effort to build a viable PPO competitor to Coventry. They’ve got some smart people (and other payers have lost same) – but the challenge will be getting Optum/UHC’s other provider negotiations people to leverage their relationships and nail down great WC contracts with deep discounts.

That’s gonna be a very tough row to hoe…

Optum WC CEO David Young – we’ve crossed swords a time or two, but he does know the PPO business inside out and sideways, and is making the right moves – but WC is perhaps $1.2 billion in revenue.

that’s a LOT…right???

Well, no.

Parent company UnitedHealthGroup [I can never remember which letters are capitalized] will rake in $286 BILLION in total revenues this year.

So, workers’ comp is…what…one-half of one percent of UHG’s total revenue…

What does this mean?

UHG will keep workers comp – partially because the Board probably doesn’t even know it is in the WC business, and partially because it will continue to throw off cash.

The problem facing Young et al is UHG is a quarterly earnings-driven company – and workers’ comp is NOT a growth business. Young will have to invest in PPO, try to get support from people who don’t know how to spell – much less care about – WC – AND meet quarterly earnings growth targets.

That’s why he gets the big bucks.