What’s the deal with long-term COVID?

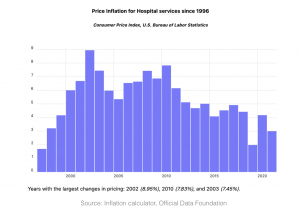

Why are facility costs increasing and where?

How will labor market disruptions affect work comp?

These and other questions will be addressed in Boston March 16 and 17 at WCRI’s Issues and Research Conference. I caught up with WCRI CEO John Ruser and Communications Director Andrew Kenneally to get the scoop.

remember these days…?

[Register here…don’t put it off as this often sells out]

COVID

26 months into the COVID era we know a lot more about the short-term health impacts of COVID (and associated medical costs and duration) but we’re only starting to understand how COVID infections affect us – and may impact work comp – over the long term. Dr Ruser noted the:

“majority of COVID claims are short duration and most don’t have medical expense, things that are going to surprise us may well be long covid associated (issues)…(we are) doing studies on covid claims and persistence in terms of services provided that WC payers are covering”

Denise Algire, Dan Allen, and Craig Ross DO are the panelists for a discussion of the workplace “after” COVID; mandates, return to worksites, and medical care are all on the docket. [I’m not sure there will ever be an “after” COVID; more likely we’re entering a “COVID era.”]

Facility costs

WCRI’s members have identified facility costs (inpatient and outpatient hospital and ambulatory surgery facility) as a key concern; one of the biggest drivers is provider consolidation. Dr Bogdan Savych and Dr Sebastian Negrusa will discuss their research into the effect of provider consolidation on workers’ comp medical payments; Dr Ruser:

“WCRI’s stakeholders raised this as a top issue…there will be some eyebrows raised as there hasn’t been research on the impact of vertical and horizontal integration’s effect on workers comp. We will discuss the implications for costs from both vertical integration and the acquisition of Primary care practices by larger health systems.“

More on this issue here here and here.

Employment

The estimable Dr Bob Hartwig will educate and engage as only he can. Somehow Dr Hartwig manages to make the densest of topics relevant and entertaining. With employment a key driver of all things workers’ comp;

“disruptions in labor markets are going to have lasting impacts on the way we work and on workers’ comp claims. Bob Hartwig is coming to talk about these disruptions and their implications for workers’ comp”

What does this mean for you?

All in all, a festival of facts, a cornucopia of content, await us in Boston…along with a most-needed opportunity to see old friends and, dare I say…shake hands?

Why?

Why? I

I