Last week I posted on Raji Chadarevian and Sean Cooper’s excellent presentation at AIS.

Here’s my what-this-means-for-you takeaways.

Drug spend decline

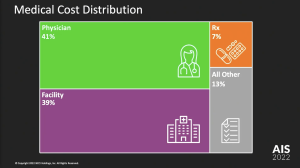

While NCCI’s reporting that dollars for drugs now account for 7 percent of annual isn’t too much of a surprise, there are a couple other factors at play here. First, the older claims are, the higher the drug costs.

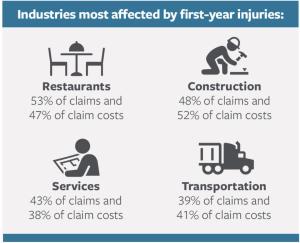

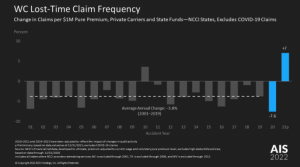

During the 18-24 COVID months that were generally pretty awful, a lot of high-severity, higher-frequency jobs disappeared. Along with those jobs went a significant number. of high cost and cat claims (fewer workers; fewer claims). In what could best be described as a mirror image of the snake swallowing the pig (you know, the big slug of stuff/incidents/whatever works its way through the system), we’re going to see a long-term decrease in drug spend due to a decrease of X% in long-term claims incurred during COVID.

Obviously this will eventually work its way through the system…that said, it’s just one more bite out of pharmacy spend.

Similarly, rehab care and skilled nursing dollars will also decline along with home health care.

Peak network

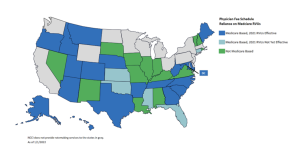

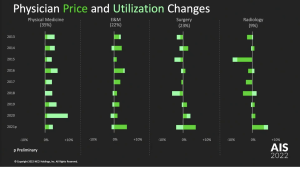

With around 75% of physician and other treater dollars going through networks, we are at – or darn near at – peak network penetration. Some states – NY being a good example – are just not going to get there due to regulations on direction and very strong provider lobbying plus employers and insurers just aren’t pushing changes.

To be precise, that refers to overall network penetration – almost all work comp networks/PPOs have carve outs for specialty services.

I make the distinction because specialty network penetration will increase – at the expense of declining PPO penetration in specialty areas (PM, Imaging, DME/Home Health etc.). This will happen because those service areas lend themselves to more active management, often involve proactive scheduling, and benefit from focused clinical management.

But, again that’s just one reason PPOs aren’t a growth thing – claims counts are declining and medical costs are flat too…

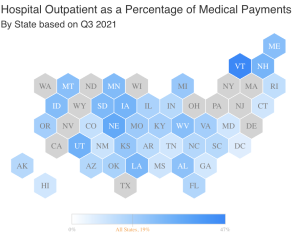

Oh, and big healthcare systems have A) figured out work comp is the golden goose, and B) are increasingly stingy with their discounts.

So, the average net discount after network fees (!!) is significantly lower than it was even five years ago.

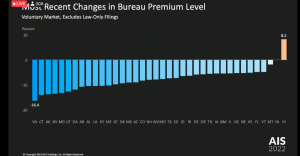

Rates are down in pretty much every state except Hawaii (betting its those damn physician dispensers in Hawaii…)

Rates are down in pretty much every state except Hawaii (betting its those damn physician dispensers in Hawaii…)