Happy Monday – for my American readers, hope your holiday was most excellent.

here’s good stuff you might have missed…

WCRI is hosting a no-cost webinar on Behavioral Health in Workers’ Compensation Thursday Dec 15 at 2 pm eastern. The webinar will discus their recent primer on BH in WC (available here for download)

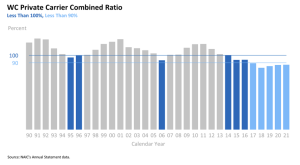

The good folks at NCCI published their latest take on work comp industry financials...suffice it to say the party continues…although it may be getting close to ending.

courtesy NCCI

The final countrywide analysis of 2021 results shows:

-

-

- WC Calendar Year 2021 private carrier net written premium (NWP) increased from 2020 by 0.5% to $38.2 billion

- The WC Calendar Year 2021 private carrier combined ratio was 87.2%, and the operating gain was 23.7%

-

Meanwhile early data makes 2022 look even better; direct written premiums were up almost 10% over 2021, while the loss ratio for the first two quarters of 2022 is even lower (!!!) then 2021 (no figures cited).

Unpacking this –

- If 2022 numbers hold up 2022 will be the tenth year in a row profits exceeded the historical average…

- And the sixth consecutive year the operating margin was above 20%

- Oh, and this all happened while rates decreased every year since 2014

My take…insurers are still enormously profitable because rate declines aren’t accurately accounting for the opioid hangover.

[A CWCI report addressed this issue; my informed opinion is claims without opioids are much less costly, therefore the continued drop in opioid prescriptions is driving lower claims costs…actuaries develop rates based on historical data – which is not keeping up with what’s actually happening.]

Former Labor Secretary Robert Reich believes organizations aren’t valuing workers correctly…Reich notes workers are considered “costs” instead of assets, a mis-characterization that leads to all manner of bad executive decisions.

Key line –

“increasingly, corporations aren’t just production systems. They’re systems for directing the know-how, know-what, know-where, and know-why of the people who work within them.”

Hat tip to a very good friend for the head’s up.

What does this mean for you?

- It’s great to see behavioral health get more exposure – it is a key driver of recovery.

- Actuaries use historical data to project the future; execs should factor in what’s really happening to understand where things are heading.