The collapse of two banks and rescue of two others (so far) sent tremors throughout the financial world.

First and perhaps most importantly it looks like most workers comp insurers had very little – if any – exposure to either SVB or Signature. So even if the Feds had not stepped in to keep all depositors whole, work comp insurers’ financials would not have been at risk. While there’s lots of external factors that the comp industry has to worry about, this doesn’t look line one of them – at least not directly.

I spoke with Bickford Actuarial’s Mark Priven to get his take: Mark is a very well-regarded actuary and good guy to boot. Here’s his view:

I don’t think there will be a lot of fallout in the insurance P/C insurance industry in general. A good source of info on this would be Best’s Aggregates & Averages, which shows the industry balance sheet broken out by asset type. One would expect carriers would have a high percentage of invested assets in high-quality bonds. A very low % would be in cash/cash equivalents potentially sitting in a bank. But it’s possible that there are particular companies that have a lot of money tied up with some of the affected banks.

Fortunately insurers (unlike banks) aren’t subject to “insurance runs”. While the insurance liabilities are substantial, they claimants receive get their benefits dripped on them over an extended period, and claimants don’t have a lot of ability to demand immediate payment. Part of the delay is the whole legal process, settlement agreements and related factors.

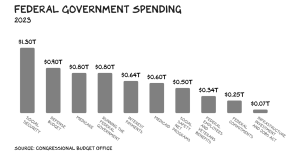

What I am worried about is the debt ceiling. People keep telling me that since the consequences could be so severe, it’s in everyone’s interest to reach a deal on that. I disagree. If Rs or Ds think that they can blame the catastrophe on the other side, then they could very well want to bring it on.

I’ve got a couple other queries out and will share what I learn.

What does this mean for you?

Nothing (much) to see here folks…