Yesterday we dug into the difficult position Texas Mutual is in thanks to Texas’ Legislature and Governor.

Today – as promised, why forcing Texas Mutual into a business it has zero experience in will NOT solve Texas’ healthcare mess – and may actually make it worse. (note this is NOT TM’s fault…it is stuck in a very difficult situation through no fault of its own)

First, TM is planning to sell stop-loss and Level Funded plans…let’s be clear – Level Funded plans have been sold in Texas for years; there are a lot of brokers offering these plans throughout the state.

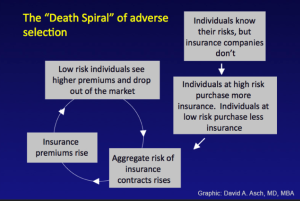

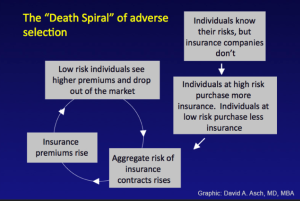

In a phrase, Adverse Selection.

I’ve written about this a LOT – mostly back in the 2000s before the Affordable Care Act came into being and effectively ended adverse selection and the insurance death spiral it creates.

Here’s the Cliff Notes version…

- Thanks to the ACA, health insurance companies cannot:

- charge people or their employers more if employee(s) have pre-existing medical conditions

- refuse to pay for care for those pre-existing conditions

- refuse to insure the employer if its workers or their family members have pre-existing conditions.

- Back in the pre-ACA days, health insurers got really good at “medical underwriting” aka identifying and refusing to insure or upcharging anyone who might have the temerity to file a claim. Why?? well, capitalism baby!.

- What happens when employers with young, healthy workers drop health insurance or don’t buy it, self-insuring instead of joining other employers in a health insurance “pool”?

- the “mix” gets worse; without that employers’ premiums helping cover other employers’ costs, health insurance premiums rise for all the employers left in the pool.

- over time,

- the number of employers in the pool drops,

- healthcare costs zoom (as only sick people who really need insurance stay in the pool)

- eventually the insurer goes bankrupt as it can’t charge enough.

Let’s suppose Texas Mutual’s program to sell self-insured health benefit plans (NOT HEALTH INSURANCE) to smaller employers is a rousing success, and hundreds/thousands of employers ditch health insurance and sign up. (TM is proposing to sell “level-funded” health benefits plans, a type of self-insurance)

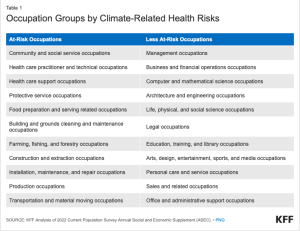

Remember, TM will be medically underwriting employers that apply for health benefits plan. As the incredibly knowledgeable (and friend) Louise Norris writes;

Medical underwriting refers to the process by which a life or health insurer uses an applicant’s medical history to decide whether they can offer them a policy, and whether the policy will include pre-existing condition exclusions and/or a premium that’s higher than the standard rate.

Costs will be lower for TM’s health benefits customers because their employees’/families’ heath risks are lower than the average Texas employer’s.

Good for those healthy employers! – they get health benefits for their workers and their families at a lower price.

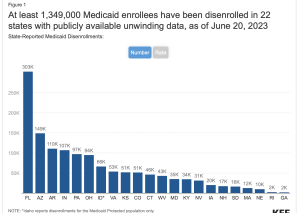

But…costs for employers left in the health insurance pool go up. And Up. And Up.

So, those employers apply for a Level-Funded plan…but

…some of their workers/workers’ families have pre-existing conditions, so at best they will pay more, at worst those conditions won’t be covered OR they won’t be offered a plan.

What does this mean for you?

this, dear reader, is why forcing Texas Mutual to offer smaller employers health benefit plans will NOT solve Texas’ health care problems.

For a much more detailed discussion of adverse selection, see here.