Well that was a GREAT Thursday.

The FED announced that not only is it not raising rates, it plans on cutting interest rates next year. While that’s great news indeed, what drove the FED decision shows the economy is doing well – and will get better.

From Reuters quoting FED Chair Jerome Powell:

- “We are seeing strong growth that … appears to be moderating.

- We are seeing a labor market that is coming back into balance …

- We’re seeing inflation making real progress,” [emphasis added]

In fact, personal consumption expenditures inflation is seen ending 2023 at 2.8% and falling further to 2.4% by the end of next year

And, betting markets predict the FED rate will drop 1.5 points – below 4% – over the next 12 months.

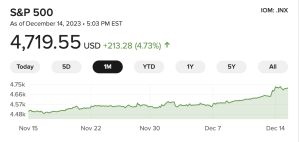

Stock markets boomed, with the DOW hitting an all-time high and the S&P close behind.

And home mortgage rates are back below 7%, and headed down from there.

What does this mean for you?

- Lower credit card interest rates so consumers will spend more,

- cheaper mortgages will mean construction will increase,

- which means more jobs.