Since its last-minute recapitalization three years ago, things have been quiet on the financial front for One Call. That changed yesterday; credit rating firm Moody’s released the results of a credit review – which were not good. [you can access the review by registering with Moody’s – there is no cost]

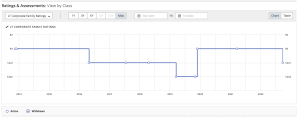

Historical corp rating changes from Moody’s

First, the summary. [I’ve written about One Call extensively; you can find other posts here]

Moody’s downgraded One Call’s Corporate Family rating to Caa1. According to NASDAQ, Caa1 is:

“A rating within speculative grade Moody’s Long-term Corporate Obligation Rating. Obligations rated Caa1 are judged to be of poor standing and are subject to very high credit risk.”

Here’s Moody’s summary:

The ratings downgrade reflects the company’s challenges to grow earnings and reduce its very high leverage which stood at over 10x as of June 30, 2022. Despite initiatives to improve operating performance and preserve cash, and Paying-In-Kind interest on the second lien notes, Moody’s expects One Call to generate small positive free cash flow which will not allow for material debt repayment. Without a material improvement in operating performance and meaningful debt reduction, Moody’s expects One Call’s capital structure to become increasingly unsustainable.

- One Call has a LOT of debt – as in almost 11 times more debt than it has in EBITDA (earnings) – and it is growing.

- One Call has to use a lot of its cash flow to pay interest on part of the debt.

- it does NOT have to pay interest on another chunk of the debt, but if it doesn’t, the missed payments are [usually] added to the principal – which increases the amount of debt (this is known as Payment-in-Kind or PIK debt); this is kind of like credit card debt)

- as this debt increases it constrains One Call’s financial flexibility, making it hard to invest in technology, people, product development, and other stuff.

- Moody’s goes on to note that a lot of One Call’s revenue comes from a relatively few customers – this concentration (in Moody’s view) increases pressure on One Call as the loss of one or more of these customers would make it even harder to pay down the debt.

MCM – What impact – if any – will the rating change have on One Call’s customers?

JK – None. We have positive cash flow, strong liquidity, no pending debt maturities, and the backing of some of the world’s largest, most respected investment firms. We talked with many clients yesterday who expressed this was not a concern for them. They continue to be pleased with our strong value proposition, commitment to service, and superior solutions for them and their injured workers.

MCM – After One Call’s recapitalization two years ago, did the current owners (shareholders) continue to hold a significant amount of debt? If so, it strikes me that Moody’s concern about governance risks may be overstated. Thoughts?

JK – Our current owners hold nearly 50 percent of our debt. This is a very real symbol of their commitment to our mission of getting injured workers the care they need when they need it. I believe we are the only company in the industry with an ownership group that also supports the company by participating in the debt structure at such a high level. The shareholders have a high amount of confidence in our team and strategy. So yes, I believe Moody’s concerns are overstated.

MCM – As hiring has continued to increase, and employment as well, it appears likely that claim volumes may also see a slight increase. Any observations or trends relative to claim volumes you can share?

JK – Over the last three months, we have seen month-over-month, low to mid-single digit increases in referral volumes. Some of this increase is seasonal, some of it is related to the macro-economic factors you mentioned, and some of it reflects market share gains we have achieved in 2022. September volumes month-to-date are consistent with this trend, setting us up for a strong fourth quarter.