The brainiacs at CWCI presented the results of their latest research last week…video is here.

I’m a big fan of CWCI’s work because:

- it is super timely – much more so than any other research organization

- it covers almost all California claims

- CWCI’s researchers are very insightful and

- they explain the implications clearly and concisely.

Top takeaways…

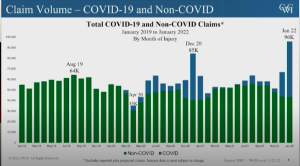

COVID is one persistent bugger…the repeated peaks are driven by variants – reminding us that viruses evolve, adapt, and persist.

The major jump in January 2022 was driven by Omicron…January numbers were 13% higher than the previous peak – remember Delta?

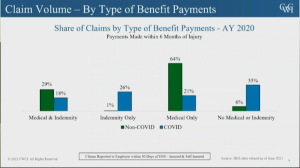

That said, and yet another reminder – to date COVID claims have NOT been a major cost driver – far from it, and that’s primarily because COVID claims either A) didn’t incur any payments or B) didn’t incur significant medical spend..

[According to CWCI’s Rena David, The majority of the “no medical or indemnity claims” may well be mostly those that were reported by the employer when there was a possibility a worker had COVID exposure but either the claim didn’t go forward or there wasn’t a positive test.]

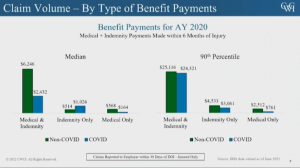

While median costs for LT COVID claims with medical expenses were modest – and a lot lower than non-COVID claim costs, the gap narrowed considerably for claims at or about the 90th percentile for LT claims with medical expense.

BUT COVID claims were still less expensive for non-COVID claims – as if we needed more proof that COVID claims will not break the bank.

What does this mean for you?

As goes California, so goes the rest of us – just a little later.