Premiums and injury claims are way down; profits remain really high.

Those are the key takeaways from just-released analyses of COVID’s impact on comp from NCCI and WCRI (WCRI report free to members, fee for non-members).

That’s also what Mark Priven and I predicted last summer. I highlight that not to crow but rather to point out that these findings were quite predictable. And others’ grave concerns about COVID hitting profits were completely off the mark.

First, the qualifiers.

- NCCI’s report includes private carrier data reported by NAIC through September 2020. Things got a lot worse late in the year, so it is highly likely premiums and injury claim drops increased somewhat.

- WCRI data covers results from 27 states during the first half of 2020

Claim decreases

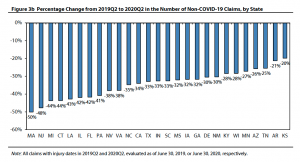

WCRI’s data shows a stunning decline in non-COVID claims (MO and LT) across the 27 states from Q2 2019 to Q2 2020…a 30% + drop in the vast majority of states.

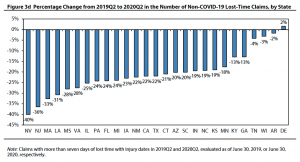

Not surprisingly, the decrease in LT claims – while still dramatic – wasn’t as large.

The net – overall, claims dropped by more than a quarter in the vast majority of states.

Also, WCRI found that the severity of the outbreak was strongly correlated (my word not their’s) with the decline in non-COVID claims.

Implications

- TPA revenues suffered as claim counts declined

- Medical management revenues in the second half of 2020 almost certainly dropped significantly (compared to 2019). Fewer new LT claims = fewer bills, fewer network encounters, less need for case management and UR

What does this mean for you?

- With COVID infections exploding – and the criminally inept vaccine rollout – we will almost certainly see a reprise of Q2 2020.

- You can expect this reprise started in December and will continue thru April.

Joe:

Do I detect a musical background within your last words? Happy New Year!

Hey Joe – happy New Year to you!

perhaps there’s a tune resonating…