The only demonstrable impact of facility consolidation is higher prices.

There’s also solid evidence that more concentrated health care markets are associated with lower health care quality.

While the number of deals dropped by about 21% in the first half of this year as everyone’s attention focused on COVID and the impact thereof, a number of transactions still took place. Conversely, several deals in process totaling around $23 billion were abandoned, victims of a variety of challenges.

Consolidation may actually accelerate as facilities hammered by the financial impact of COVID19 seek safe harbors.

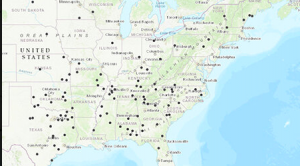

The latest consolidation is in the north-central part of the nation, with 2 not for profit systems working on an a deal driven in large part of a desire to help the systems expand their footprint.

I’d expect more, although the increasing number of facility closures may well put a damper on deals as some run out of time.

This is particularly damaging in rural areas, where over a hundred hospitals have shut their doors over the last decade.

What does this mean for you?

There will be fewer hospitals tomorrow than today, which likely means higher prices.