Moody’s report on the impact of COVID19 on workers’ compensation says stuff I agree with, namely:

Premium dollars will drop.

Rates will drop.

Claim counts will drop.

It also says profits will be pressured and future earnings reduced, asserting presumption and issues related to furloughed workers’ claims “could lead to…rising costs for workers’ compensation insurers.”

Whoa there cowboy…not so fast.

Reality is insurers are still collecting billions in premiums while claim counts and claim expenses are way down – and the cost of COVID claims is minimal. Unless premium income drops dramatically and/or COVID claim costs explode, work comp insurers’ profits are going to increase – not drop.

Here’s why.

As reported in my second survey of the Impact of COVID19 on Workers’ Compensation, claim counts plummeted in the first half of 2020 – but premiums did not.

Respondents indicated workers suffering relatively minor injuries are not reporting them. This isn’t surprising, as a) past research shows this happens when employment declines, because b) workers fear reporting a claim may affect their employment.

Next, workers with existing claims can’t/won’t access needed care. Yes, this likely extends disability duration, but it also reduces medical expense. Eventually medical expense may catch up – or not as there’s evidence some foregone treatment is not “made up.”

So, fewer claims and lower costs = higher profits for insurers.

Next – premium income.

Unlike auto insurers, there are no reports of workers’ comp insurers giving back or rebating premiums. Businesses that have closed permanently aren’t paying premiums, but most are still afloat and paying their bills.

Second, there’s no indication insurers have ramped up premium audits – which would result in credits or refunds to employers due to lower payroll. Unless and until those audits are done, employers that slashed their labor costs won’t get a refund.

So, premium income is declining somewhat – but expenses have dropped more and faster. Net – higher profits for insurers today.

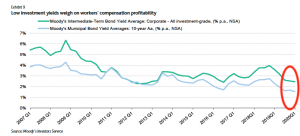

Moody’s also opines that low interest rates and lower reserves will “pressure profits.”

First, interest rates have dropped since COVID came to our shores, but not by much, so I don’t see that the impact will be significant.

Second, insurers are still way over-reserved – and since actuaries base future claims on past experience, and we don’t have any past experience with pandemics, I find it hard to believe insurers will decide to slash reserves.

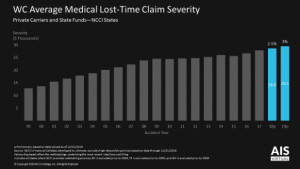

Third – and perhaps most important, medical inflation – or, more accurately, there isn’t medical inflation – which wasn’t addressed in Moody’s analysis. There is no evidence of significant medical cost inflation in workers’ comp. Yes, facility costs are problematic in some states, especially Florida. This has been countered by a dramatic drop in drug costs, driven in large part by much lower opioid dispensing.

The net – medical inflation is in the low single digits – likely lower than most actuarial forecasts.

So, while there may be a little pressure on future profits, it won’t amount to much.

Finally, COVID and presumption.

The industry’s reaction to presumption law changes is reminiscent of the caterwauling over medical marijuana – lots of noise about not much. Reality is:

- Few COVID claims incur medical expenses.

- COVID claims aren’t expensive – on average COVID claims with medical expenses cost less than the typical lost time claim

- The impact of presumption changes has been minimal.

What does this mean for you?

Workers’ comp insurer profits aren’t likely to drop much – until a price war starts.

When (not if, but when) insurers start the inevitable war over market share, profits are going to drop – a lot.

Lastly, it does the industry no credit to continue keeping premiums high when employers and governments are getting crushed. It is time for insurers to stop the “yeah, but what if…” nonsense and do the right thing.