The small business sector is in deep trouble – with big implications for workers’ comp – starting with what looks like an 8% decrease in monthly premiums and equivalents due to massive layoffs and business closures.

Without immediate funding from the SBA’s $350 billion Paycheck Protection Program (PPP) and Economic Injury Disaster-Relief Loans (EIDL), many small businesses will disappear. Work comp premium payments will dry up and jobs for laid-off, injured and sick workers will too.

Here are the implications for workers’ comp; details on why small business is in deep trouble follow.

My best estimate is annual premiums and equivalents will be down about 10% by the end of April. Here’s the math:

In December of 2019 average annual income was $48,700. Workers’ comp insurance costs on average $1.30 per $100 of payroll for a total of $633.41 per year or $52.71 per month.

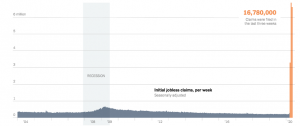

Businesses with less than 500 workers account for about 60 million jobs (I know, 499 workers is a pretty big “small” business, but that is how many entities categorize “small); credible sources estimate we’ll lose somewhere around 12.3 million small business jobs.

note this includes ALL jobs, not just small employers

Multiplying the average payroll cost of workers’ comp by the average monthly wage, then by the number of layoffs adds up to a loss of about $650 million in workers’ comp premiums every month, or roughly $50 million for every million jobs lost.

NASI reports total premiums and equivalents were just over $97 billion in 2017; that equates to about $8 billion per month.

Given earlier job losses coupled with yesterday’s announcement, my best guess is we will be down somewhere around a billion dollars in premium and equivalents by the end of the month.

The small business support situation

Okay, now for the current status of aid for small businesses.

Hundreds of billions of dollars have been earmarked to help businesses stay afloat, and more billions are on the way. That’s great – but only if those dollars actually get into businesses’ bank accounts. So far, that has not gone well.

Business owners were told Small Business Administration (SBA) dollars would be flowing in “days” and depending on their need and the size of their business, they could get loans and grants up to $2 million.

The programs are a clustermess.

Business owners are getting conflicting answers from the SBA – when they get any answers at all. If anything, lenders are worse off, unable to get clear guidance from the SBA. Grant amounts under the Economic Injury Disaster-Relief Loans (EIDL)’s Advance program have been reduced to a maximum of $10,000 – or less (depending on which official you listen to). Banks are already running out of SBA money, making business survival dependent on how fast you get to the front of the line.

Initial loans have also been capped – at a maximum of $15,000. And applications for long-term loans under the Paycheck Protection Program (PPP) are also in limbo, with applicants desperately hoping they’ll get relief before it’s too late. Many business owners have heard nothing about their applications for grants and loans despite hours stuck on hold. I

It’s easy – but wrong – to point the finger at incompetent government bureaucrats or lenders.

The SBA’s is woefully understaffed, its computer systems haven’t been updated for decades, and went without an official leader for nine months, a permanent leader appointed just three months ago. Neglected for far too long, the SBA just isn’t ready or able to do what needs to be done.

I provide that detail so we’ll understand that things are not going to improve quickly – and improvements will be scattered and spotty.

Implications

Fewer jobs = less payroll, fewer premium dollars for insurers, fewer claims for service entities, less medical care for providers, and less income for others in the workers’ comp ecosystem.

Joe, thanks for the great information. It really reminds me to keep looking at the big picture and plan accordingly.

It’s possible the opposite may be true if you’re a small business with solid operations and financials. So often the large corporations have waste and duplication of effort, unlike smaller companies. If you’re a small business with little debt, had a strong Q1 and have a team that thinks of the company as their own, you’ll do very well. The way a dedicated team at a small company devotes themselves in tough times is nothing short of incredible. Could it be that the small companies will come out stronger when this is done? I know that I’m keeping a list of “Things I learned from Covid19” and I imagine my colleagues at the smaller companies are doing the same.

One of the things I’ve learned in doing business with small, community based, American companies is how responsive/adaptive/effective we are during tough times. As an example, we bank with a regional community bank and I am able to text our rep. Our application was submitted last Friday and the SBA relief was in our account by Thursday (yesterday). I’ve heard stories of desperation from colleagues who bank with the big guys.

As you know, I am huge fan of the American Dream of a successful, family owned business, and I know you are as well. I never imagined I’d be in a position like this; it’s really a situation no one could have planned for. I’m so thankful for our team AND our bank and of course our government’s understanding of the contribution of small business on our economy.

To quote our friend Spencer French, “without this pandemic, leadership would be kinda boring”. (Hope that made you and your readers chuckle like it did me).

I’d like to hear your thoughts on where this relief money is going to come from.

Thanks again, Joe

Hello Robin – apologies for the difficulty posting; will check to see if there’s a problem here.

Re where the money will come from – it appears the Fed is printing money by issuing new debt and creating liquidity by buying up debt as well. Ultimately it will come from our kids – and I hope they can afford it.

Spot On Joe. Our smallish TPA does exclusively WC claims in MT. Our experience with the SBA process is exactly as outlined in your piece. Further, not only is the impact to claims organizations a current issue, it will have a longer term impact. Businesses closed = no claim incidents. No claims to process reduces long term income for claims entities. While the larger entities can address a margin of the impact upon revenue by dropping costs, the current rave is to have all staff work from home, in the long term downward pricing pressure upon all wc claims entities will exist. Further consolidation? Furthering the distance between the wc professional and their recovering worker?

thanks Michael – this is one of those times I’m sorry I’m right.

Interesting issue; TPAs that charge on the basis of a flat fee for the life of the claim aren’t setting aside reserves to pay for future claims handling. So, if they go belly up, the employer will have to pay for another claims handler to take over the file. This may be a real risk especially for TPAs with a lot of debt and/or poor cash positions.