Employers, state funds, and insurers are focusing more and more on closing old claims; the most successful ones are partnering with their Pharmacy Benefit Managers.

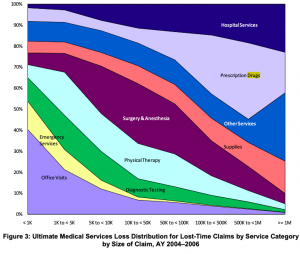

The logic is clear – the older and more costly the claim, the greater the percentage of spend is for drugs (except for those cat claims needing long-term home health/facility care).

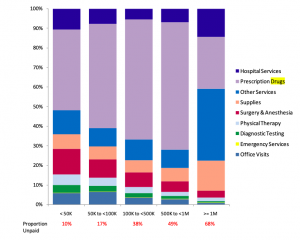

And, the higher the reserves, the greater the percentage of those reserves is for drugs (except for those cat claims needing long-term home health/facility care).

Both graphs from NCCI; Medical Services by Size of Claim—2011 Update.

While some very large payers (e.g. Ohio BWC, Washington L&I, State Fund of California and Sedgwick) have strong clinical pharmacy capabilities, most payers don’t.

If you are looking to reduce your claims inventory, partnering with a PBM with:

- real expertise in analyzing legacy claim information,

- very strong clinical capabilities, and

- a demonstrated ability to help manage legacy claims is mandatory.

What does this mean for you?

Find out if your PBM has these capabilities – and ask how they can help you. If you aren’t impressed, find another PBM.

Hi Joe,

Hi Joe, We, at MagnaCare, completely agree with this post. Two years ago we built a Pain and Opioid Management product. We also saw that many of our customers were not taking nay steps to address the long standing claimants with opioid addictions. Our Chief Medical Officer retained the services of a Pain Management specialist, an Addiction Psychiatrist and paired them with a team of care coordinators and social workers. They not only review the case to determine an alternative treatment plan, but work woth the claimant, and their treating provider for up to a year to assist that claimant through the weaning process. The results have been very impressive. Helping an addicted claimant through their issue, will take more than data analysis and a new plan. It also requires cooperation, communication, and support.