in which I cover newsworthy stuff that happened this week…

Uh…that’s why you buy insurance

From Politico we hear CMS Administrator Seema Verna asked us taxpayers to pay for $47,000 worth of jewelry and other stuff stolen “during a work-related trip.” Among the valuables gone missing – that she wanted us to pay for were a $325 moisturizer (!!!) and $349 for noice-canceling headphones – plus a $5,900 Ivanka Trump pendant.

Yep, the person who runs the biggest insurance entities in the world wants the government to bail her out because she decided to NOT buy insurance. (update – good news, we aren’t paying for Ms Verma’s bling)

Physical therapy in workers comp

MedRisk released its third annual report on PT in WC earlier this week. 560,000 work comp patients were served by MedRisk so far this year; the average duration of care has shrunk to 11.2 visits over 48 days. Better news – 98.1% patient satisfaction rate and 97.7% of providers agree with MedRisk’s clinical recommendations.

There’s an old business meme that comes to mind – “stick to your knitting.”

At a time when other service companies were seeking to become everything to everyone, Shelley Boyce, Mike Ryan and their colleagues at MedRisk went the other direction, focusing narrowly on work comp physical medicine. Along with the best management team in the business, they executed the plan to perfection. (While MedRisk is an HSA consulting client, all the credit goes to those folks).

Meanwhile all the caterwauling about drug prices turns out to be much ado about nothing (I’m looking at you, AARP) . This from the estimable Adam Fein PhD’s discussion of CMS’ review of healthcare costs:

-

- For 2018, spending on outpatient prescription drugs grew by 2.5%—below the spending growth rate on hospitals, physician services, and overall national healthcare costs.

-

- CMS significantly lowered its previously reported drug spending figures by billions after incorporating new data on manufacturers’ rebates.

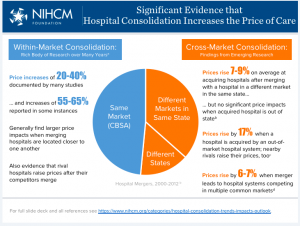

More news showing hospital consolidation raises your healthcare costs.

From NIHCM comes a terrific slideshow – my favorite is this one – key takeaway is prices ALWAYS GO UP after mergers.