In which I read current research and summarize key takeaways so you don’t have to…

Stress over healthcare costs doesn’t go away when you are on Medicare

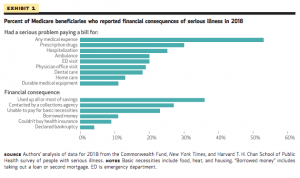

HealthAffairs reports that more than half of Medicare recipients with a serious illness reported “serious financial distress” due to medical bills. Drugs are the most common cause, followed by facility bills.

This is important because:

Medicare for All is NOT a panacea; politicians advocating for MFA should understand Medicare needs major improvements before it is “ready for prime time.”

Oh, and a third of all credit card holders are in debt due to medical bills.

Immigration and healthcare

If you or a parent have a healthcare aide, listen up. The bruising battle over immigration and the “Dreamers’ will affect healthcare – particularly for older Americans who rely on home health aides and other lower-level clinical support.

27,000 Dreamers work in healthcare and healthcare support, many providing individual care. The Trump Administration is trying to end this program and force Dreamers to leave the U.S.

The shortage of home health workers is particularly acute in older states such as Maine and the upper midwest. With immigrants filling one of every three home health positions, ending DACA and further restricting immigration would leave thousands of older Americans without care.

What does this mean for you?

When a politician says something is simple, or their claims just seem to make sense, your alarm bells need to ring.

Medicare will need huge and expensive changes to work for all of us.

If you don’t want immigrants in the US, then you get to care for your parents without any help.

The largest facility bill you can get on Medicare is about $1400. Depressing that this amount could put so many persons into financial distress. (by facility I mean room and board at a hospital.)

The bills from Part B of Medicare can be 20% of doctor and office visit and diagnostic test charges. One can get a Medicare Advantage plan to cover nearly all those charges for about $70 a month.

The drugs are the big problem. Most Part D plans assess coinsurance charges of 25% on the most expensive drugs…so the patient might be paying $1000 a month every month with no cap. This cries out for Part D reform and where possible price controls.