Two seemingly-unrelated papers hit the inbox yesterday; CWCI’s just-completed analysis of opioid usage in the Golden State, and NCCI’s report on 2019 workers’ comp financials.

The key takeaways from NCCI’s report include:

- Premiums are expected to drop 10 percent in 2019, driven by rate/loss cost filings. In other words, losses are declining which leads to lower insurance costs.

- This marks the sixth consecutive year of decreased premium levels.

- Not coincidentally, 2019 is the sixth consecutive year of underwriting profitability.

So, even though premiums are dropping like a rock, insurer profits are better than they’ve ever been.

Why?

Well, declines in frequency are certainly a big contributor. Reduced worker benefits are likely a factor as well – and a big problem we’ll address in a later post.

If anything, investment profits are a drag on profitability (NCCI reports 2018 investment gains averaged 9.2%.

Which brings us to CWCI’s report “The Impact of Declining Opioid Use on Lost-Time Claim Development & Outcomes in California Workers’ Compensation” [emphasis added; disclosure – I provided input as a peer reviewer for the final report]

Key takeaways:

- “from 2008 to 2017, chronic opioid use…declined from 13% to 3% of all lost-time claims (a relative decline of 77%)”

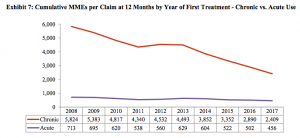

- the strength of the opioids dispensed within the first 12 months of treatment, measured in cumulative morphine milligram equivalents, declined 59% for chronic opioid use claims

Tomorrow – the connection between opioid reductions and premium levels – and what it means for the industry and you.