The takeaway from the American Hospital Association’s “study” of hospital mergers is NOT that mergers are good for patients, employers, and taxpayers.

It is that all of us should be skeptical readers of research conducted/paid for by entities that have a stake in the results.

The report authored by Charles River Associates – and funded by the AHA – on mergers and acquisitions in the hospital made several claims, all focused on the hospital that was acquired:

- mergers reduced expenses at the acquired hospital;

- quality at the acquired hospital improved; and

- revenue per admission decreased.

Clearly the intended message is that mergers are good for us – quality goes up and the cost to us – the patients and employers and workers comp insurers, go down.

Except that’s highly misleading.

If the authors had included results from the acquiring hospitals this would have been much more useful. Overall, the report provides no useful insights into the changes in costs, revenues, or quality resulting from mergers.

Second, the study reported expense reductions from mergers are relatively small at 1.5% to 3.5% of total expenses. As I mentioned to

WorkCompCentral’s Elaine Goodman, most every merger outside the hospital industry produces expense savings at or very close to double digits, thus the

“cost-reduction” benefits touted by the AHA are rather less than impressive.Second, claims about improvements in quality of care are not convincing for two reasons. First, statements about types of improvements consist of examples cited by interviewees. Second, as the acquired hospital may transfer, or more likely, not accept higher-acuity patients, it is not surprising that their quality measures (re-admissions, mortality rates, etc) improve. Healthier patients = better quality ratings.

Third, the report indicates ” acquisitions are also associated with a reduction in net patient revenue per admission “ at the acquired hospital. There could be many reasons for patient revenues to decline, including moving more critical patients – who cost more to treat – from the acquired hospital to the acquiring hospital. Changes in Medicare and Medicaid reimbursement could also be a factor. Notably the report did not discuss revenue reductions across the newly merged entity.

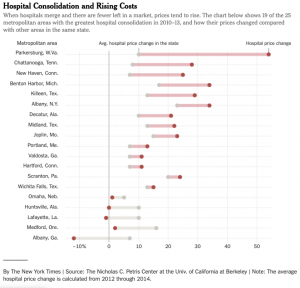

Here’s what REALLY happens to hospital revenues…

What does this mean for you?

For workers’ comp payers, don’t think this is good news..

Note – For years I have been doing research on several issues important to work comp – pharmacy, bill review, claims systems, utilization review. Some of have been sponsored by companies active in the space – but they’ve never had access to respondent-specific data nor any input into the analysis or report writing process.

Still, you should read all my research with a careful eye – as you should read all research.

This study appears to be consistent with our direct experience as a WC TPA payer. In more rural jurisdictions, the consolidations lead to less competition, which it seems to have a direct impact upon access to, quality of and cost of care. Similarly, it is our experience that similar results are taking place with the “roll up” of so many single state and regional WC TPA firms. Unfortunately, total loss costs tend to increase despite the buyer/client showing a savings on the direct TPA claim handling expense.

Spot on, Joe! And how have those airline, healthplan, bank, insuror, oil/gas, telecom and big pharma mergers worked out for the paying public? Love those testimonies in front of Congress extolling the virtues of how cost-cutting directly benefits the consumer. Prove it post-merger. It would seem reducing competition, capacity and/or consolidation always provides additional pricing power to the remaining incumbent(s), yet no one seems to make that a part of the narrative.