NCCI Chief Actuary Kathy Antonello’s presentation on the state of the industry has just too much information for a single post – so here’s three key details.

Reserves

Private carriers are over-reserved. That means there’s several billion dollars of excess cash on carrier books. I’d note that this ASSUMES the projections are accurate, and that losses for already-incurred claims don’t get worse (or, in insurance-speak, develop upward).

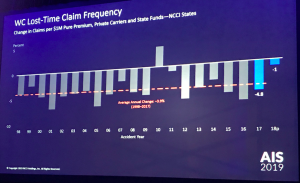

Frequency

Lost time claim frequency declined by 1 percent last year – significantly less than we’ve seen over the decade. My take is this is related to several factors.

- Employers aren’t focusing on work comp issues – e.g. safety and loss prevention – as premiums are so low that they aren’t a problem.

- Hiring standards have been relaxed as we’re at full employment

- More overtime is being worked, leading to higher injuries due to tired workers

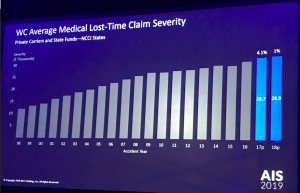

Severity

Medical costs went up a mere 1 percent in 2018, continuing a trend of relatively low increases that’s persisted since 2008 (the jump of 4.1% in 2017 looks like an aberration).

What does this mean for you?

Workers’ comp is not a problem for employers – which means it will get little attention from legislators.

When buyers aren’t experiencing pain, they have little reason to buy.

Hi Joe. Thanks for the info. I appreciate it. I had a quick question as I read this two different ways. You stated, “When buyers aren’t experiencing pain, they have little reason to buy.” so does this mean if things are going well then they will be less likely to look at new initiatives because they don’t need them to improve claim management OR with the savings they are getting they are more willing to spend money trying new things? Or maybe both? Thanks.

Hello Spencer – you’re most welcome.

Yes, unless buyers perceive they have a problem, there’s no incentive to find a solution. So, tougher to get them to switch vendors/partners.