Recent posts have focused on defining Medicare for All/Single Payer and the problem both are intended to solve – healthcare prices in the US are the problem.

Today, we’ll figure out what you really pay for healthcare.

That’s pretty darn important because we’ll need to compare what we pay now to what we’d pay for any MFA or other model.

First, it’s insurance costs, deductibles, and copays. For a family of 4 with one person in poor health, the total is about $7850 this year.

Then there’s the $1400 in state and federal tax payments that go to fund healthcare – you know, that FICA thing, plus state and federal taxes that pay for Medicaid, plus VA funding, Tricare, Indian Health Services, and lots of other programs I don’t know about.

Next, your employer’s insurance and tax costs – which total $13,050 in health insurance premiums and $750 in Medicare payroll taxes.

The total? $23,500 for a family of four.

You may be…surprised to learn $5,700 goes to administrative expenses. All that paperwork, utilization review, billing and reimbursement stuff costs serious money.

What does this mean for you?

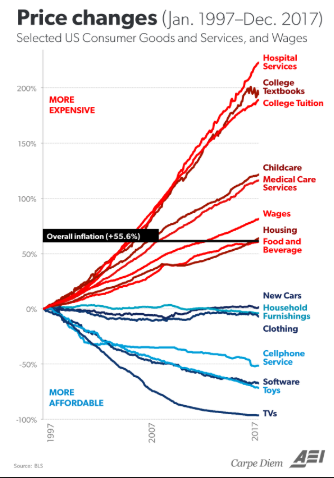

US health costs twice as much as in many other countries – that have the same or better outcomes.

What would you do with another $11,750 in cash?

Joe, You are bringing up important information that most folks do not consider linked. How could they? Most don’t have to deal with them directly. At 24%, administrative costs – in some respects, the least transparent category of those you list – bears probing with the same energy we need to explore any other cost of healthcare delivery in the USA. Let’s also ask the question, “What would the medical industry – including administration – do with only half the revenue?

Thanks for the comment Steve.

Admin expense absolutely needs attention – and I’ll get a bit into that tomorrow.