Kudos to NCCI for including an excellent discussion of blockchain in this year’s Annual Issues Symposium.

(Prior posts on blockchain are here.)

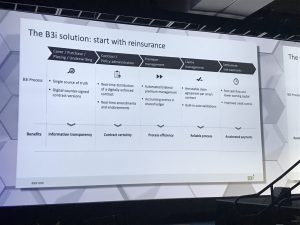

This is starting with reinsurance; a good summary is in presenter Paul Meeusen’s summary slide below.

Meeusen and his colleagues and business partners have moved very, very quickly. Many of the bigger names in insurance, reinsurance, and other service entities came together in December 2016 to figure out if and how to work together on blockchain.

Now, less than 18 months later, a company is working to set standards, coordinate communications, and define working processes.

Rather than get into the nits of this, I’ll focus on impact.

Remember – P&C insurance’s administrative expense load is stupid high.

And work comp is perhaps the worst offender; about 30% of premiums go to stuff other than paying claims. That administrative expense is, in the view of blockchain advocates, proof that WC is very inefficient. Therefore there is a significant opportunity to strip out costs while improving data quality, speeding up transactions, and reducing employers’ and taxpayers’ expenses.

The business case for blockchain – which I’m using here as a description of a broader use of technology to replace today’s cumbersome, error-prone, and high-friction administrative system – is so compelling as to render it inevitable.

It also means there are going to be a LOT more opportunities for consumers to insure things that are valuable to them – objects, events, structures, trips, you name it.

What this means for you:

- Many of us who are “frictional cost” are going to lose our jobs.

- Service companies who make their money doing admin work are going to lose their customers.

- And other vendors, especially small ones who can’t afford to adapt to blockchain, are going to find they can’t service their customers.

- But there are great opportunities for creative insurers to find new niches to service customers.