After several years of intense activity and billions of dollars invested in the work comp service industry by a score of private equity investors, it’s time to take a step back and figure out what’s worked, and why.

And what hasn’t. Namely outsourcing and offshoring customer-facing tasks…

(this is the first in a several-part series)

This isn’t about what’s worked for investors, but rather what works in work comp – better service, fewer screw-ups, improved patient care, lower cost.

For those not steeped in workers’ comp, a bit of background is critical. Vendors winning a big national contract may just be getting a “license to hunt”; the executive’s signature on the contract is just the start of the real heavy lifting. Success is about the wholesale sale and the retail sale.

To translate a contract into revenue, vendors need to understand how REAL decision makers – the front-line folks – work, what they want and don’t want, like and don’t like, how they are evaluated, assessed, and bonused, what’s important to their bosses, how their IT systems and applications and security works and interfaces/doesn’t interface with the vendor’s systems/apps/security. Sure, every vendor thinks about this and works at it, but not many do it well.

More to the point, every encounter with an adjuster, case manager, or patient is critical to the outcome of the claim. An angry or upset patient will call an attorney, a satisfied patient will not.

With that as a basis, let’s talk about what happens when investors who don’t understand this buy work comp service companies.

With its strong focus on growth and debt service and cost cutting, the new owner employs a strategy that’s worked really well in other industries; reduce costs thru automation, off-shoring, and out-sourcing.

Their thinking is that many of these tasks can be handled faster/cheaper if a computer does them. If a computer can’t, then someone in Asia, South Asia, or Central America can. After a consulting company does an analysis of workflows, operations, and systems, the vendor’s US operations are shut down, work is outsourced, and the owners watch the profits leap.

Except, they don’t. Leap, that is.

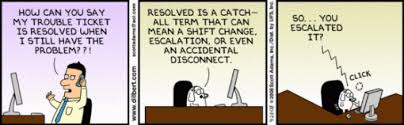

That’s because you can’t automate or outsource customer service.

Customer service is delivered in every encounter with every current or potential customer. It requires a boatload of pre-work:

- developing your products and services to increase the chance for success and reduce the opportunity for screw-ups;

- building IT systems that deliver the necessary information to those who can act on it when they need it in a form they can understand;

- hiring, paying, and motivating workers with service at top-of-mind; and

- training, re-training, and educating workers so they are confident and capable.

Then, it’s about execution.

- ensuring your customers can understand what your people are saying and vice-versa;

- empowering your people to address and resolve every issue for anyone who calls, emails, tweets, or instagrams;

- connecting those customer-facing people with management and staff so the lessons they learn, complaints they here, and opportunities they identify can be used to improve your core products and services;

- quickly and with minimal red tape.

We’ve all had frustrating customer service encounters with poorly-prepared customer service reps that don’t seem to grasp an issue, can’t address a specific problem but seem to think they can, or are difficult to understand. This is NOT a slam at those reps, but rather at the companies that employ them. Putting a person in a position where they don’t have the tools to do the job is a management failure.

The front-line, desk-level work comp professional has no time to deal with “customer service” that isn’t. Claims adjusters and case managers need their issue resolved now. Not after lengthy conversations, multiple voice mails and transfers and back-and-forth emails, now.

That’s because their “customers” – workers comp patients and their employers – are anything but standardized. State regulations, employer requirements, patient needs and wants, physician/provider policies, and the adjuster/case manager’s individual work style make for for complex and constantly-evolving workflows.

Simply put, while much of this can be standardized, documented, and scripted, some cannot – and it’s those encounters that spell success or failure for vendors.

The problem facing investors is this: automating, outsourcing and offshoring customer-facing activities has been wildly financially successful in many other industries.

Not so much in workers’ comp, where every encounter with an adjuster or patient is critical to the outcome of the claim.

Some have learned that lesson, but many have not, and that’s the subject of tomorrow’s post.

Align Networks….ARE YOU READING THIS????!!!! One of the most frustrating companies I have to deal with on a day to day basis

Great article Joe, While all things in today’s world can be automated and handled without human intervention it does not mean that they should be.

Right on Joe!

God Bless, the American worker and the workers compensation business that needs us even if that need is driven by necessity, only.

It is truly frustrating. Perhaps the CEO’s of the companies that outsource should sit in the seat of a person that does phone work for a living and see how they like to deal with language barriers, hit several different prompts and listen through a 10 minute recorded message to find out one has reached the wrong department, be disconnected or be on hold forever. Sadly, in the grand scheme of things nothing really gets resolved other than another phone call and the vicious cycle begins all over again.

Excellent info, Joe (I hope the investment guys are listening)! There are some back offices tasks that can be off-shored, i.e. document management. However, a function that engages or touches the client, injured worker or provider should NEVER be off-shored. This isn’t rocket science. The money you save upfront will be lost on the backend (and the clean-up).

Hear, Hear! Paduda nails it again!

there is a very fine line here. get into a serious discussion with any claim leader and one will find that the number of claims folks they have is actually the number of different approaches they have to the claim management process and the number of differing levels of claims expertise. This is certainly true when it comes to making authorization decisions related to medical issues which will have a major determination on outcome. The functional integration of analytics into the process can provide exceptional tools that do improve decision-making and outcomes. While, I’m not at all an enthusiast of off-shoring as an efficiency strategy…that does not mean there are not ways to use technology to make the claim professionals role more efficient and more rewarding while also working some magic on the loss ratio.

While this may be good information for the investors and venders,what do you say when a claim adjuster tosses out some magic numbers toward the claimed and states that there is a huge overpayment.But can not break it down as to what point did this overpayment start.The incentive to cheat is written into Michigan’s Compensation law,”what you RECOVER you keep.

William – welcome to MCM. I don’t follow your comment; this post isn’t about adjusters paying claimants, it is about basic service models.

Am I missing something here?

Joe, another issue that plagues these investors which is especially apparent through all of the market consolidation over the past few years is their inability to realize that the companies they are buying might actually perform the customer service and IT functions better than themselves or the parent company. Instead of embracing the better customer service and IT people/processes/systems that they just purchased, everyone is given a pat on the back and a pink slip (and forced to honor at least a 1yr non-compete).