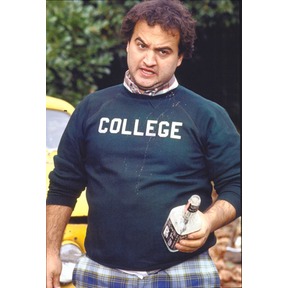

Refusing to accept reality, the efforts of some states, individuals, corporations, and elected officials to “repeal and replace” Obamacare continue; a recent conversation on Mark Walls’ WCAG focused on this issue as well – with far too much demagoguing and scare mongering. Bluto would be proud.

The “plans” to replace Obamacare typically include some/all of the following:

- allowing people to buy insurance across state lines

- providing a refundable $2500 tax credit to all to buy insurance

- giving states block grants to use for their Medicaid programs and freedom to spend it however they want

- funding high-risk insurance plans for people with pre-existing conditions so they can get coverage when insurers reject their applications.

- additional tort reform

Let’s briefly review these ideas, focusing on their implications for coverage and cost control.

Coverage across state lines

Folks advocating this idea base their view that selling coverage across state lines will reduce costs by eliminating mandated benefits, which one wag says would reduce costs 30-50 percent.

Ha. That view reflects a complete lack of understanding of the cost drivers in health insurance, the primary driver being – you guessed it – the cost of medical care. For anyone to suggest that a person in Massachusetts will save thousands if they can buy a policy sold in Idaho is lunacy. yes, mandates do influence costs, but the underlying cost of insurance is the cost of care.

Refundable tax credit

People can’t buy insurance for $2500, so giving low-income people that amount won’t make them buy it as it is still unaffordable – especially if there’s no mandate to do so. Moreover, many who don’t have insurance couldn’t get it due to pre-existing conditions, and no insurance company would sell insurance to anyone who may end up costing the insurance company lots of money. That would be foolhardy.

Block grants

Good idea, if they actually use the money to increase the coverage and benefits for Medicaid eligibles, instead of trying to dissuade or discourage potential eligibles from signing up.

Funding high risk pools or insurance plans

These have been tried, and almost all have failed miserably as states don’t like to keep funding them. Florida’s high risk pool has been closed for years, and only a couple hundred citizens are still covered. Moreover, this dumps the potentially high cost individuals on taxpayers, allowing commercial insurers to cherry-pick the best risks that will generate the largest profits.

Tort reform

Tort reform will not appreciably reduce medical costs.

Research indicates defensive medicine accounts for 2.4 percent of US health care costs. That’s not to say medical malpractice and associated costs are not significant contributors to health care costs as they most certainly are. However, the majority of malpractice victims never pursue a claim.

Of course, lost within this mishmash of convoluted half-thoughts and unworkable, un-informed, and simplistic “solutions” is a rather awkward truth; the individual mandate and other key parts of PPACA, currently reviled as socialism, communism, or worse, came from ideas advanced by conservative icon William Kristol, right-wing think tank Heritage Foundation, Sen Orrin Hatch (R UT) and former GOP Presidential candidate Mitt Romney, among others.

So, repeal and replace, with, what?

The issue of buying insurance across state lines was always pretty flimsy

Before 2014, most states allowed full underwriting in the individual market. A healthy person could get a cheap policy, and many did.

States like New York had guaranteed issue, and New York even had community rating.

So it was obvious that a healthy person in NY could get a much cheaper policy in Arizona.

Since the ACA, this argument is not just flimsy it is somewhat nonsensical.

Based on my research, incidentally, the various mandates like maternity care and contraception add only 5-10 per cent to premiums. What really drives up premiums is guaranteed issue,

Bob,

You are wise beyond your years! Guaranteed issue is the premium cost driver.

Joe:

As normal you and I disagree on several points.

The Cost of Health Insurance may well be driven by the Cost of Health Care. The Cost of Health care is driven by supply and demand. Double the number of doctors and doctors fees will fall substantially. I suspect that using tax dollars to put doctors through school would save far more than subsidizing individuals to pay high fees. Tell the drug companies they can’t charge more for drugs in the US than they charge anywhere in the world and US Citizens would save untoward billions. I buy our family drugs through Canada. I recommend any primary economics text for a explanation of supply and demand and the effect on prices.

Tax Credits: Who pays for it. The Federal Government who is 17 Trillion Dollars in debt and has 100 Trillion in unfunded liabilities. Socialism is great until you run out of other peoples money.

High Risk Pools.

The people who need them can’t afford them. They don’t work and we agree on that. There may be some way to partially fund those. I am not sure of the answer. But throwing them into the pot with every citizen is not the answer. The answer may well be something on the order of Workers Comp pools, we all end up paying a little to help the less fortunate.

Tort Reform: I would point out the efforts of tort reform in Texas and the very satisfying results. Texas is now a state plaintiff attorneys avoid, not seek out.

Keep up the conversation but the PPACA passed once by one vote and could never pass again. Is this really good law?

The implementation is a disaster. The true breadth of the disaster it is will unfold over the next few years. The employer mandate! The rising fines! The young and healthy that refuse to join! The miniscule difference between the highest and lowest premiums that has no bearing on the real needs or usage of the participants.

Of course there is the pernicious effect on our “National Identity” as a nation of Individuals not sheep!

Charles

Charles – thanks for the comment. always good to disagree appropriately.

Couple thoughts.

1. you state “The Cost of Health care is driven by supply and demand. Double the number of doctors and doctors fees will fall substantially”

That is unsupported by any research that I could find. Please provide a citation or citations to support that assertion. In fact, increasing the supply of medical providers has increased demand, as demonstrated by research dating back to Wennberg’s analysis of hospitalization rates in New Haven and Boston.

2. Funding of high risk pools has been and continues to be a disaster. While there “may be some way to partially fund these” all efforts to do so to date have failed. btw your idea, where we all pay a little to help those less fortunate, is one I absolutely support. that’s what government should do.

3. Tort reform – I cited a well done study about the medical malpractice myth. In fact, research indicates tort reform in TX has had no impact on medical costs. And that, not the effect on attorneys, was my point.

4. Telling drug companies what they can and can’t charge is price-fixing. That may not be welcomed by their stockholders, and would undoubtedly lead to court action as it could be unconstitutional.

The implementation of the website has been – to date – a disaster. However, none of the suggestions offered by any opponents for reform would lead to greater coverage or lower cost. Far from it.

Finally, I don’t know what you’re referring to when you say “The miniscule difference between the highest and lowest premiums” Age bands? Benefit plans?

Joe:

First point. Simple supply and demand. If you raise the supply high enough the price will fall. This has been proved over and over through the centuries. if you will Google “supply and demand in healthcare economics” you will find a number of studies. There is additional complexity introduced into the equation by the way we pay for health care, in this country, the fact that the recent history is clouded by longevity increases and falling costs do increase participation in the system. If medical care were free, as it will be for many people under the PPACA with the promised subsidies. people will have no reason not to get care at every turn for everything however minor. But It is apparent from the papers available that there is a consensus on supply and demand do effect the cost of Medical Care. If you want I can cull the ones I have read and forward the cites to you.

Second Point:

Yes, we should help our fellow man. “There but for the Grace of God, go I.” But first they must help themselves as much as they can. Many don’t take advantage of the high risk pools because it would affect their lifestyle. Cheaper car, cheaper apartment, less travel, less partying, sparser Christmas, whatever. As long as they are not made destitute by the premiums, is it my responsibility to help? Who chooses what is to much to pay? You? Me? Surely not the IRS? I know, professionally, what the IRS will allow a person or family to keep to live on if they owe taxes and are being levied for those taxes. The IRS is wrong. People can’t live on what the IRS allows. Frankly many times the same situation exists with child support garnishments.

3. http://setexasrecord.com/arguments/290927-texas-shows-tort-reform-works-for-everybody-except-greedy-trial-lawyers

This current article highlights “Texas Tort Reform” and some of the cost savings including in the medical field. There are other article as well.

4. Price fixing is if several companies get to get together to set prices, much like OPEC.

I am suggesting only that the government refuse to allow the drug companies to make huge profits off the American Citizen and the American Tax Payer. Drug companies sell drugs for much less all around the world for a number of reasons. If they are going to sell them cheaper in India then either insist that they sell them for that price in the US or that Americans can buy those drugs direct from India. The Big Pharma has bullied Congress and the FDA into letting the US pay for all the drug research and their profits. That is unconscionable and a incredible dereliction of duty by the Congress, most members which need to be returned to the real world so they can see and feel what is reality, not beltway wonderland.

The “Miniscule difference” refers to the fact that the premium for the highest risk patient under PPACA can be no more than 3 times that of the lowest. That does not recognize reality. An 22 year old Wisconsin lad working in an office in Madison, engaged to his childhood sweetheart, and a member of the local Methodist Church and a youth leader with great grand parents still working the farm is not one third the risk of an 82 year old blind, syphilitic, diabetic one legged man in a Mississippi hospital being treated for a debilitating stroke. So why are should premiums of our Mississippi patient be allow to be only 3 times higher than our Wisconsin lad. Or as bad the other way around. Is the cost of care different only 3 to 1. I don’t think so.

One other point that people are not talking about is that the government subsidies are in the form of tax credits. The poor don’t have any tax taken out of their check so they can’t adjust their withholdings and will not see any credit on the 2014 premiums paid until sometime in 2015. Even this year the tax return filing date has been delayed. How many poor are going to drop out month 2,3 5, or 8 because they can’t afford to send the check? That was really well thought out!

Joe a pleasure as always, you make me think and writing things out solidifies my points.

Thanks,

Charles

Charles

Re supply and demand and impact on health care I’m afraid you’re wrong. As I noted many many studies indicate medical card is supply-driven. You allude to that in your statement vis a vis free insurance and free health care as a driver of cost; as it is “free” there is no constraint on demand, thus demand expands to meet the available supply.

Regarding the additional medical cost associated with medical malpractice, the article you referenced does not have any conclusions regarding the impact of tort reform on medical expense. In fact, the credible research indicates the additional costs are 2.4% of total spend. That is hardly a good case for tort reform as a panacea. There is also research specific to Texas which indicates the tort reform had NO impact on medical costs.

Re: Mississippi and Wisconsin. Affordable care act does not have anything to do with inter-state variations in prices. They can vary by any amount in fact one of the issues is the costs for insurance very substantially across states. I think you’re referring to the Age bands which are specific to each carrier and each benefit plan.