Texas has some rather troubling healthcare problems…and Texas’ legislators are asking the state’s largest workers’ comp insurer to help solve those problems.

First, a few Texas healthcare data points…

- more Texans are uninsured than in any other state, access to care is the fourth worst in the nation, the same is true for healthcare affordability.

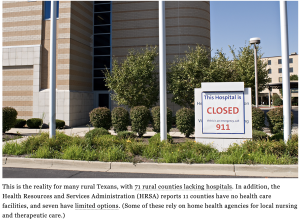

- The access issue will likely get worse, as the Texas Hospital Association asserts one of every ten facilities is at risk of closure.

- Rural facilities are most at risk with one in four at risk of closing. Overall Texas hospitals are in pretty poor financial shape, about half have negative operating margins.

- One out of four working-age Texans don’t have health insurance – double the national average – and far more than in Mississippi.

- One of every nine kids is uninsured…more than double the national average – and a higher percentage than Mississippi’s.

- Medicaid enrollment is dropping a lot due to the end of the Public Health Emergency – which will add to the rolls of the uninsured and further hammer providers’ finances.

Of course, one of the big issues is Texas refuses to expand Medicaid for reasons I must admit are confusing at best.

And the Feds are looking to cut almost $9 billion in funding; Texas has a convoluted tax-and-transfer thing in place which CMS believes is illegal…

I’ve been digging into this of late…collecting background information, interviewing the leader of TM’s new venture and reaching out to legislators behind a bill that asked required Texas Mutual to help (details below); TM is in the process of standing up a health insurance entity that will begin operations early next year.

From the State’s website:

HB 3752 allows a subsidiary of the Texas Mutual Insurance Company to provide a health insurance product to Texans. The goal is to increase access to affordable health insurance for individuals, especially those in rural communities, and employees of small businesses.

Effective Date: September 1, 2021.

The bill would also require the company to fully explore methods to increase health insurance competition, use innovation to increase quality of care for lower costs, avoid discriminating against patients with pre-existing conditions and provide transparency when developing health benefit plans.

(3) ensuring adequacy of benefits and access to care for individuals in this state with preexisting conditions;

(4) issuing coverage in a manner that does not discriminate against individuals with preexisting conditions;

Not later than September 1, 2022, the company shall submit to the legislature a report explaining how any anticipated health benefit coverage offerings would comply with all considerations and guiding principles for developing health benefit coverage offerings under Subsection (a). This subsection expires January 1, 2023.

Gotta admit, this is a head-scratcher.