Wednesday I dropped the first five predictions; today we’ll finish up.

6. The workers’ comp insurance market will stay soft.

Here’s a few reasons why.

- There’s hundreds of billions of capital floating around out there, looking for a home. Workers’ comp insurance has been a) quite profitable and b) is a great place to park dollars.

- Claim counts continue to decline – while COVID is accelerating the decline, the structural drop is embedded in the business and is here for the long term. Next year there will be fewer claims, and the following year even fewer.

- Medical inflation remains pretty low (while there are troubling indicators that costs will bump up, overall trend remains low historically)

- There are lots of insurers fighting for a shrinking market, and it only takes a couple cutting prices to force others to join in.

7. More layoffs and staff reductions will hit insurers and TPAs

See #6 above. Fewer premium dollars = fewer administrative dollars; fewer claims = less need for staff. Layoffs hit several insurers last year and we can expect more to come.

8. Other than presumption and tele-services, there will be very few significant moves in WC regulation or legislation.

Between drastic reductions in state revenues due to sales and other tax receipts affecting staffing and state legislatures and governors all-consumed by COVID responses and budgetary issues there’s little oxygen left to fuel any material changes to work comp regs. While it would be great to see Florida’s legislature stop facilities raiding workers comp to make up revenue shortfalls, that’s highly unlikely.

9. OneCall will be sold and/or broken up

While the current debt load is a LOT less than it was under the previous owners and the current CEO is an improvement, the decline in claims hit One Call hard in 2020. The first half of 2021 won’t be any better with employment numbers and claims counts likely reduced due to the pandemic. On the plus side, there’s still lots of investor money looking for deals.

Net – I expect the company to change hands this year. Whether it is sold as one entity or broken up is TBD.

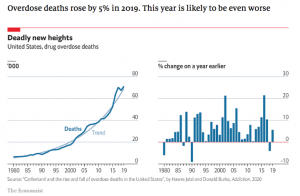

10. Opioids and other dangerous drugs will get a lot more attention.

With COVID dominating everyone’s calendar, workload, thinking and energy, we all dropped the ball on managing opioids. That will change.

chart below is from The Economist.

With prescription volumes, MEDs, and duration likely up during 2020, expect payers to re-engage with prescribers, PBMs, and employers to get things moving in the right direction.

What does this mean for you?

This is going to be a very busy year, with more change than any we’ve seen in a long while.