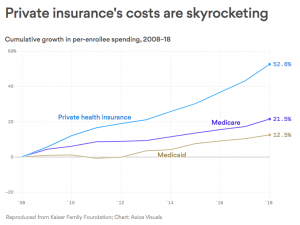

If you had “government” health insurance for the last decade, your costs would be 20 – 25% lower today.

That’s because private insurers have not controlled spending nearly as well as Medicare and Medicaid have. This from KFN via Axios.

Doesn’t matter what your economic or political ideology is – that’s a fact.

You and your insurance company pay your doctors and hospital more than twice what Medicare does. Yes, the Feds can exert pricing power – but why can’t United Healthcare, or Aetna, or Blue Cross?

Those healthcare giants should be able to negotiate better deals with providers; they have massive buying power and millions of members to leverage. They should be able to use that power to give you lower insurance costs – but they can’t.

Those private insurers are (theoretically) more nimble, smarter, better run, and more efficient than the government. And they have hundreds of billions of healthcare dollars to leverage.

Yet they’ve failed to outperform a bunch of bureaucrats.

I won’t dive into the “whys” today, because that would take away from the over-arching truth – government has been much more effective than private insurers.

What does this mean for you?

Cutting your health insurance costs by a quarter = more dollars you could have spent on other stuff.

note – happy to hear other thoughts; please use citations to back up any assertions.

I cannot pretend to know all the ins and outs of private insurance as I am really just learning slowly. I guess my thought is what if we just took better care of ourselves? That maybe dumb, but if we as the people maintained a healthy lifestyle, how much would that drop costs? I can only assume a lot.

Thanks for the note Rick. Healthier lifestyles would certainly reduce costs; the conundrum is we’d live longer. It’s not clear if that would reduce costs, or just put them off for more years.

Interesting statistics, but considering the fact that many on Medicare also have supplemental insurance policies, I wonder how the combined benefits of Medicare and supplemental insurance benefits compare to private insurance. I know of physicians who decline to take new patients who only have Medicare and “grandfather” existing patients on Medicare, but do take new patients who have Medicare and supplemental insurance coverage.

Hello Terry

reimbursement levels for Medicare Supp patients are identical to straight Medicare. Can’t comment on those physicians you know; that’s anecdotal at best.

Is that not related to Obamacare requiring coverage for services not previously covered, whereas these type services are unlikely to be required by Medicare or Medicaid populations?

Hi Myrna – thanks for the question. This isn’t related to the ACA’s requirements re benefits. Several key points:

– most ACA benefit requirements are very similar to those benefits already offered by employers

– the ACA benefit requirements didn’t kick in until January 2014, six years into the analysis done by KFN depicted in the graph

– the Benefits provided by Medicaid and to a lesser extent Medicare are much more robust than even those required by ACA.

hope that is helpful – Joe

Private insurances are not able to control the costs as do Medicare and medicaid, because they are losing market leverage to the monopolies and oligarchies that hospitals are creating, and lack legal authority to set rates by fiat. Hospital to payer – you private payer, pay these higher rates or my entire “system” will be out of network, and since we dominate the market you want to sell your product in, guess you lose. Without a provider network, the payer is out of business.

Hello Robert and thanks for your comment.

I respectfully disagree for several reasons.

– not all provider markets are consolidated at a high level, therefore payers have varying amounts of pricing leverage.

– health insurers such as UHC employ thousands of physicians who could be/are used as part of a provider network.

– health insurers certainly have the capital to invest in setting up their own provider networks with owned practices and out-of-area Centers of Excellence as has been done by several large employers

That said, some markets are particularly problematic; in these instances payers can and should set up their own delivery systems with employed providers.

In fairness to private insurers, they are in many ways forced to subsidize what are perceived as low payments from government programs – with providers saying they need more from private insurers to make up for the less they get from government programs, and government supporting them in that. The providers have done a good job of convincing government that if private insurers paid what government does – as with just adopting Medicare or Medicaid rates – and could make the same utilization decisions, hospitals would close and providers would quit. Ask a provider what would happen if private insurers simply adopted Medicaid rates!

Hello Sam – good points all.

I’d argue that there’s an inherent cost-plus issue in play. CMS determines reimbursement in part based on provider costs, which provides no incentive to manage those costs.

Other point – American physicians, health care execs, device companies and pharma make a shipload more money than they would in any other country. So, yes, some might walk away, but over time the system would balance out.

It would be interesting to see (if at all possible) the differences in care provided & outcomes between the two. Does paying more or less have a direct impact to medical outcomes?

Hello lb – I’ve never seen any data showing a positive correlation between higher medical costs and better outcomes.

Joe, I guess the underlying question is: what incentives do private insurers have to reduce spending? Arguably, this would require additional investments of time and resources that wouldn’t necessarily be reflected in higher premiums or greater market share. I’m not sure that they are sufficiently motivated to undertake this effort which would meet with resistance and conflict from the medical community.

Dr Jake – thanks for the observation.

There’s actually an incentive to NOT control costs; built-in medical inflation drives revenue growth = happy Wall Street.

However, if the government became the sole insurer, it’s most likely medical prices would still skyrocket. They would be taking on tremendous lifestyle risk, plus the government would need to update their systems to incorporate 80% of the social and environmental risk that isn’t currently factored into their calculations–only the 20% clinical risk is accounted for. We all know too well how government does with replacing legacy systems! The significant opportunity from health risk factor change and its impact on workforce productivity would be forgone by single payer. Incentivize change in the private system, so that structure finally follows strategy, like it’s supposed to and the problem will be solved. As Mike Thompson, President, National Alliance of Healthcare Purchasing Cooperatives says, “Employers need to step up to lead change for the system.”

Hello Frank – thanks for the comment.

I’m not sure I understand how medical prices would skyrocket. Medicare’s fee schedules are in place to prevent that from occurring.

Medicare and Medicaid are already dealing with lifestyle risk; Medicaid is the largest funder of opioid addiction treatment in this country. Medicare pays for treating patients due to their lifestyle-driven health conditions.

Every institution has challenges with replacing legacy systems. See Kaiser’s IT overhaul, any insurer’s claims system replacement, any Oracle or SAP installation for proof. Federal systems replacement are made much more difficult by insufficient budgeting by Congressfolk who don’t understand or care about those agencies’ missions.

Joe, Thanks for the thoughts. I can see by the replies that others find the topic intriguing as well. There are a lot of metrics that cut across the marketplace and can be used comparatively between Medicare/Medicaid and Commercial, but It’s a challenge to think of cost control as being one. CMS has created a false market with regard to competition and belly-button leverage. ie, we’re big and marketplace dynamics tied to customer selection don’t exist. Providers of all stripes take their lumps on CMS pricing dynamics because they have to. Whether or not they like to admit it, Commercial carriers are in competition for docs, hospitals, clinics, etc, and this gives the provider community leverage – manifesting in the cost curves shown above. No question about it, these numbers don’t lie, but the comparisons aren’t equal, and the cost containment expectations shouldn’t be either. This is what we pay for things like “choice”, “quality”, and “convenience”. My bigger question come November is whether or not this will matter to anyone who’s not an economist in healthcare. Sure looks flashy to the general voting public, but questionable if these results would be sustainable over the long haul, and if so, does the program come at the cost of all of the reasons we chose to buy private insurance?

Hello Benjamin and thanks for the comment. Appreciate your thoughts.

I’m not sure I follow your logic. United, Aetna, the Blues and others have market power in many markets, yet they have not figured out how to effectively leverage that power – or perhaps they aren’t trying hard enough.

Medicare and Medicaid are also in competition for providers; one can see the issue in interstate variation in Medicaid participation by docs, but participation is pretty high in most states despite low reimbursement…that suggests some providers are willing to take low reimbursement.

One other thought; payers could always build their own delivery systems – or delivery systems could seriously invest in delivering care the way it should be and not based on more stuff for more people – then set up their own insurer.

As to whether CMS pricing is fair or not – the underlying cost is what’s driving the problem, and that underlying cost must be dealt with if we are to control the beast. There’s an incredible amount of waste in healthcare, waste that shows up in prices. If providers won’t fix waste, then buyers must.