Sometimes you read things that make you squirm a bit; this article was one of those times for me.

The piece, entitled “How to Stop People Who Bog Things Down with Bureaucracy”, had me nodding my head as I replayed past experiences working for big insurance companies. We’ve all had them; there’s a problem that is readily apparent to everyone. Maybe it’s a customer’s repeated complaints about a process or missed target or service change requirement.

A meeting is convened to figure out how to address the problem.

The discussion quickly expands the issue to identify underlying causes – changing the process means several departments have to communicate differently, share information faster, streamline a well-established workflow that will disrupt current operations as staff is re-trained. Management metrics will be affected, and dashboards altered.

As the discussion progresses, you can feel the oxygen leaving the room.

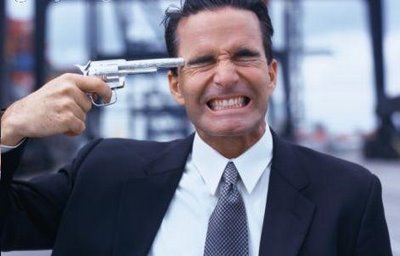

(Scott Adams has a brutally funny understanding of management)

It’s just too big, there are too many people who need to buy in and take action to fix the problem, there are other priorities, no single person can own it and fix it. An “action” plan may be agreed upon, which usually involves more meetings and memos and prioritization and risk assessment – and little action that actually addresses the original problem.

Fact is, the people who point out that this or that change will require lots of other changes may well be right.

But, while they may be technically correct, when you think about what they’re really saying, they are most definitely wrong.

Wrong because organizations – for-profit, not-for-profit, governmental – all exist to serve their “customers”, and the people who focus on the obstacles to delivering for customers are coming at this bass-akwards. Instead of thinking about the issue from their organization’s perspective, they should be looking at it from their customer’s.

Here’s how the HBR article described these well-intentioned managers…

Energy vampires are often smart, well-intentioned managers who inadvertently slow the company down with too many questions, too much analysis, too much process—and not enough action. They exist in the organization to administer various systems and processes that in isolation seem necessary, but in aggregate simply clog up the works and slow the company down.

Customers don’t give a rat’s rear end about your internal processes or metrics or management meetings. They have a need – get this service delivered this way to me in this amount of time – and successful organizations attack problems from that external perspective.

What caused me to squirm is this. I’m really good at the strategic view, at understanding customer needs and verbalizing them, but I can also be too quick to point out the potential obstacles and organizational changes and issues involved in meeting those needs. That can flip the discussion from where it should be coming from – the customer’s side – to what’s best for the organization.

In so doing, one concedes the field to the energy vampires, the “this is the way we do it here” people who keep things running smoothly – and directly away from success.

A few relatively simple things you can do to address this very real problem.

- Keep problems simple. Don’t overcomplicate things.

- Eat the elephant one bite at a time. Sometimes there are issues that require lots of organizational change; don’t try to do it all at once.

- Start with high-value changes with a very high chance of success. This builds momentum and credibility and support.

- Reward intelligent risk-taking, and dis-incent the overly cautious.

- Accept some downside, understanding that overall, the net result is what matters, not ensuring every effort is a successful one.

What does this mean for you?

Think about the last meeting you had about a customer issue, and what is happening as a result of that meeting. I’m hoping your organization focused on the “how” and not the “why we can’t.”