That’s a bit of a misstatement; ACA alone is not responsible for increasing the number of insureds by some 20 million, but there’s no question it was the primary causal factor.

Be that as it may, let’s examine who the newly-covered are, what they do, and where they reside. The insured population’s demographics may be of interest to workers’ comp payers.

As noted yesterday, the newly-insured population is poorer, more likely to be recent immigrants, and much more likely to be Hispanic than the rest of the country. For work comp, what may be of more interest is the jobs they hold and where they live.

First, the percentage of part-time workers insured rose by 5.8 points, while the full-time population’s coverage went up 2.8 points. Those concerned with so-called Monday-morning injuries, may see this as a plus for work comp as more working people have insurance to pay for non-occ injuries.

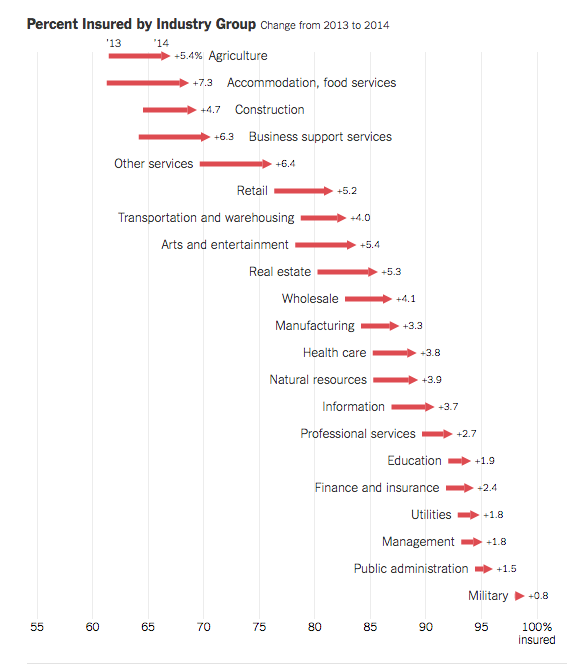

Next, what do these workers do?

Pretty much everything; of particular interest to the work comp community, several high-severity &/or high-frequency industries saw significant jumps in the percentage of workers with health insurance. (details below)

- agriculture +5.4%

- construction +4.7%

- transportation/warehousing +4.0%

- manufacturing +3.3%

- natural resources + 3.9%

Why is this important? A few reasons.

Insured people are healthier than the uninsured, so they will heal faster if they do get injured on the job.

Work comp payers won’t have to foot the bill for medical conditions non-occ-related for insured workers. This isn’t the case for claimants who do not have health insurance; actually work comp payers technically don’t need to pay for non-occ conditions, but end up paying for those conditions if by so doing the claimant gets better faster.

Monday-morning injury frequency may be reduced (if it is a real problem and not just commonly-accepted wisdom).

(chart below from NYT article)

I bring this to your attention, dear reader, because clients, friends, and all manner of industry folk are keenly interested in the “impact of ACA on work comp.” Fact is, we don’t know what it will be, but we can prepare if we look closely at what’s happening and make some educated, experience-based guesses.

What does this mean for you (work comp payers)?

A long term and incremental plus…perhaps.

Definitely a “potential” long term plus but only if those companies offering the ACA plans lower the high deductibles. Until then, it’s an uphill battle.